5 Glaring Signs You Will be Broke in 2024

If you are tired of not having enough money, you’ll want to pay attention to these signs you will be broke in the future and how to avoid them.

The fact is that 78% of Americans are living paycheck to paycheck and more people say they’re struggling to keep up with paying their bills.

But here’s the thing, the reasons why have nothing to do with how much money people make, but more so about the poor decisions we make.

If we continue to fall into these main traps, we’re destined to be broke forever…Here are the 5 signs you will be broke in 2024.

1. Lack of an Emergency Fund

The first and one of the biggest signs you will be broke is if you don’t have dedicated funds set aside for emergencies.

Most people will put their money towards bills, car, house, entertainment, and even investing, but we forget about one main law…and his name is Murphy.

The law that’s been proven over time that anything that can go wrong, will go wrong, at the worst possible time.

If we don’t have any cushion to cover these unexpected expenses, it’ll likely keep us broke forever and here’s why.

- A recent study from the Federal Reserve it showed 40% of Americans lack enough money to cover a $400 emergency expense without turning to credit cards or loans.

That’s a scary way to live because if every time something went wrong you had to borrow money to cover an expense, you would be getting charged interest.

If you’re not familiar with what interest is, it’s simply an added fee for borrowing money which can be in the form of a credit card or personal loan.

Here’s a few of the most common emergency expenses:

- Medical Emergencies – average cost $2,000

- Car Repairs – average cost $500-$1,000

- Home Repairs – average cost $1,000-$5,000

- Job Loss – losing a percentage or all of your income.

To avoid borrowing money for emergencies, financial experts suggest putting away finds into a separate account that can cover 3-6 months of your expenses.

Not only will this give you cushion to cover these emergencies, but it’ll prevent you from borrowing money and paying interest on top of it.

2. Having Car Payments

Another one of the major signs you will be broke is if you continue to swim in a sea of car payments.

Most people don’t think this way, but if you can’t pay for a car in cash, then you can’t really afford it.

Because living with car payments is guaranteed to keep you in debt and it keeps you paying a ton of high interest

- The average car payment in America now for new cars is $730 and for used cars it’s $530 and that doesn’t even include the cost of insurance and maintenance.

I will say inmost cases depending on your money situation that it’s more practical to buy a used car versus a new car.

Because one of the biggest problems with buying a new car that will keep us broke forever, is known as depreciation.

There are tons of studies that show that within 5 years a new car will depreciate about 60% of its value.

Example:

Let’s say you buy a brand new car that costs $50,000 and after 5 years it depreciates 60%, that car would then be worth $20,000.

Now over that 5-year period, you made a car payment every month, but don’t forget about the interest you paid.

When it’s all said and done, you would have ended up paying $60,000 for a car that’s worth $20,000.

So really we’d be losing money twice, because of interest paid and depreciation.

For that reason my personal opinion is only paying cash for an affordable car based on your income.

3. Not Doing a Budget

Now another one of the signs that you will be broke is what I think that most of us suffer from, and that’s not having any form of a budget in place.

Most of us look up at the end of the month and have little to no money left, but we don’t know where it went.

I get it, the word budget sounds terrible, I mean it’s like we’re getting an allowance or something.

But the truth about a budget is that it’s not about restriction but it’s about aligning your spending with your goals.

Without having a budget it’s easy for our spending to get out of control. Check out some of these statistics:

- The average American household spends nearly $18,000 a year on non-essential items.

- In 2023, the average delivery service customer is spending over $400 a month.

Uber Eats, Instacart, DoorDash, all those things add up and this pattern of overspending can prevent us from saving money, investing, or even just covering our bills.

And it just leads us down the path to borrowing money…

But if you’re looking for an easy way to control your money, here’s the best tool I found!

Rocket Money the #1 Budgeting App

Start your FREE trial today!

4. Holding Credit Card Debt

The next one of the signs you will be broke is revolving credit card debt.

Most people argue, “well what if I payoff my full balance every month,” well then you paid off your full balance and you’re not paying interest.

But the truth is, this country is in over $1 trillion of credit card debt, so many people aren’t paying the full balance every month.

Credit cards are the most common form of debt, and they charge the highest interest right next to the payday loan.

I’m not going to go into a bunch of stats as to why they keep us broke, I’ll just give show you an example.

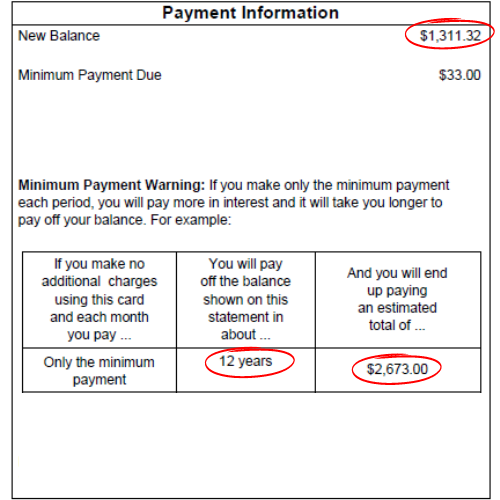

Every month your credit card company will send you a credit card statement, and on that statement is a section that has some disturbing information.

Because of interest I would end up paying over double the amount I borrowed and it would take 12 years to pay off.

But notice, these numbers are based on never using the card again…

That’s the problem with credit cards, just one tap and the cycle starts all over again where you’re paying more interest and it takes longer to pay it off.

Everybody has their personal opinion about credit cards, but I would suggest if you are in credit card debt to pay it off as soon as possible and never look back.

5. Having a Too Big of a Home Mortgage

Now one of the biggest signs you will be broke, and I know this is especially tough nowadays but it’s that your house payment equals out to be too much of your take-home pay.

- A recent study shows over 1/4 of Americans are “house poor,” meaning that their housing costs add up to be more than 30% of their take-home pay.

The problem with this is when you spend too much money on housing, you don’t have enough money left over to cover the rest of your lifestyle.

Example:

Let’s say you make $5,000 a month and your mortgage is 40% of your take-home pay, which is $2,000.

That would leave you with $3,000 to cover all the rest of your expenses throughout the month.

When you think about all the payments that we make every month, anything from car payment to utilities, groceries, subscriptions, gas, child care…

After all those things are paid it doesn’t leave much margin for unexpected expenses or to enjoy life, and it makes it really easy for us to rely on borrowing money.

For this reason financial experts recommend that your house payment be no more than 25% of your take-home pay.

Conclusion

There’s one factor that all these signs you will be broke have in common and that’s the literal price that we pay for borrowing money.

If you might be in debt and want to break this cycle check out my free guide that has seven practical and proven steps to get out of debt and start building wealth!

Your guide to get rid of debt and build wealth.

To learn about even more ways to manage your personal finances, check out our resource center.

Frequently Asked Questions:

- What are some common signs that keep people broke?

- Too much credit card debt

- Overspending on housing costs

- How can credit cards contribute to financial struggles?

Credit cards charge high interest rates and minimum payments may not cover the full balance, leading to long-term debt.

- Is it recommended to use credit cards?

It is not recommended unless you are able to pay off the full balance every month and avoid accumulating debt.

- What percentage of take-home pay should be allocated towards housing costs?

Experts recommend that housing costs should not exceed 25% of take-home pay.

- How does overspending on housing costs impact overall financial stability?

When too much of our income goes towards housing, it leaves little room for savings or emergencies, and can lead to reliance on borrowing money.

- How can people avoid becoming “house poor”?

By following experts’ recommendations and keeping housing costs to 25% or less of take-home pay, individuals can avoid becoming “house poor.”

- Why is it important to have a good understanding of interest rates when using credit cards?

Having a good understanding of interest rates helps individuals make informed decisions about their spending, and avoid accumulating high levels of debt.